Competitive Analysis

Finmo by Lendesk vs. Velocity—What’s The Difference?

If you’re new to the Mortgage Industry you might be wondering: “What the heck are Finmo and Velocity?”. And I’m glad you asked! Both Velocity and Finmo by Lendesk act as a deal submission platform.

Velocity and Finmo by Lendesk are two up-and-coming platforms that have been gaining traction in the last few years. They are the two leading fast-rising stars going after the long-standing incumbent, Filogix.

They both allow you to collect information and documents from a client, pull credit and underwrite a file, submit the file to the lender to receive an approval, and manage compliance. But there are also some key differences that you need to be aware of when choosing which one is right for your team.

Here are 5 points to consider:

User Experience

Finmo has a very user-friendly client application process, which is consistent with the positive feedback from borrowers. Top brokers pay a premium (see Network Support below) for this experience.

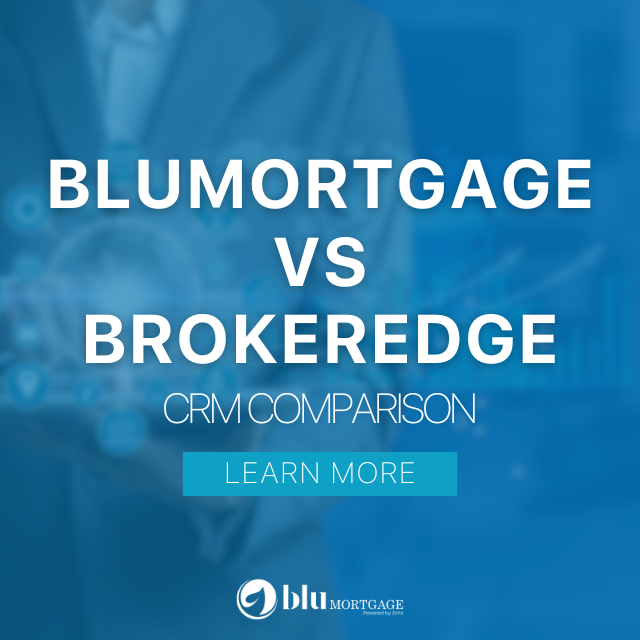

Finmo also offers something called Smart Docs, that allows you to automate the document collection process—right at the time of application. In this screen you can manually select which document you want, or accept their automatically suggestions:

Finmo offers a calculator tool where you can share a link with your clients and they can easily answer some questions to know how much they would be able to get approved for a mortgage without needing to login or have an account.

Velocity just released Client Experience 2.0 to rival Finmo’s application. Initial feedback has been positive.

A competitor to Finmo’s Smart Docs is in BETA right now, but yet too early to tell it’s real life impact.

If we had to pick a winner for this category, it would be Finmo because of its proven user-friendly application process.

Access to Lenders

Both Finmo and Velocity have easy access to all major banks and monoline lenders (ScotiaBank, TD Bank, Desjardins Bank, etc.). Both offer a place where you can see different rate options and offers for each application. They also feature the option to submit to different lenders.

Right now, Velocity has exclusive access to HSBC.

There are whispers of exclusive agreements for Finmo, but no official release has been made to this date.

If we had to pick a winner for this category, it would be Velocity due to its exclusive lenders.

Integrations

Both Finmo and Velocity have built integrations with industry-leading CRMs, like BluMortgage. These integrations allow you to automatically import leads and data from your CRM into the app, streamlining your workflow and saving time.

Both Finmo and Velocity continue to expand their API to include more data points, making it easier than ever for your team to stay on top of sales opportunities.

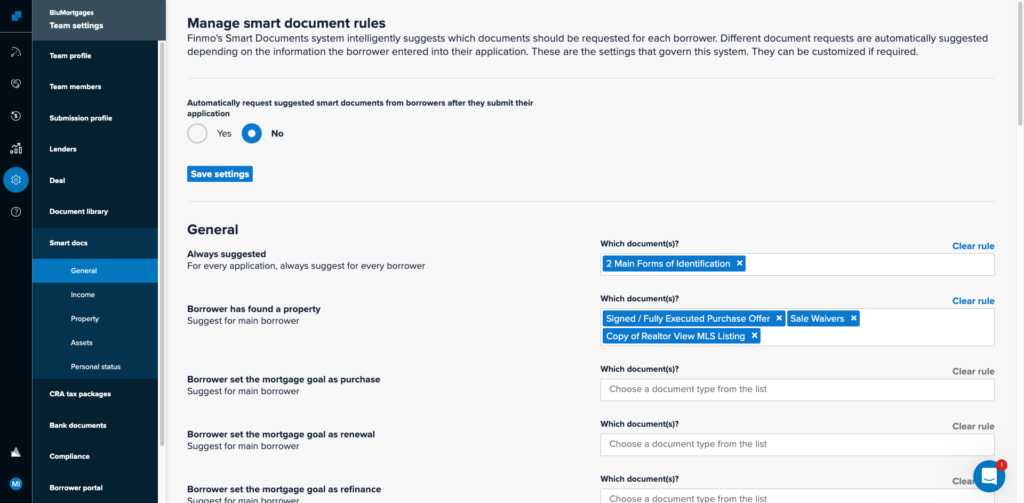

While Finmo has invested more heavily in Zapier-based connections, Velocity has slightly more methods with their API. For example, you can send a new deal to Velocity from within your CRM using the Velocity API.

If we had to compare a list of integrations available at the moment, this is what is looks like:

If we had to pick a winner for this category, it would be Finmo for the flexibility offered with Zapier-based integrations.

Other Features

Finmo and Velocity are both great platforms that offer a lot of the same features. They both have credit pull and integration with NOA (Notice of Assessment) providers. Please note that the Credit Pull and NOA is a premium feature for both, and e-sign is a premium feature for Velocity.

Velocity offers a tool called Discovery where you can compare scenarios and products/offers based on a few different filters based on Client, Product and Property.

Finmo has a direct competitor to Discovery called Lender Spotlight, an online database of lender products, embedded into its product to serve up lender recommendations, and compare scenarios to share with clients.

The biggest difference is Velocity has a CRM. But if you’re over $10M in funded volume, you should have a CRM that you own, like BluMortgage.

If we had to pick a winner for this category, it would actually depends on your funded volume. Being Velocity for under $10M in funded volume, and Finmo if over $10M in funded volume.

Network Support

While Finmo itself does not charge a fee, if you are a broker that’s part of Dominion Lending Centre (DLC), Mortgage Architects (MA) or Mortgage Centre Canada (MCC) networks, you will be charged a $200 fee (by the network) for each deal funded in Finmo, which can add up quickly.

However, if you’re a non-DLC/MA/MCC broker, you should be able to use either Finmo or Velocity with no issues.

If we had to pick a winner for this category, it would be Velocity since there are no fees associated with submitting through this platform (regardless of network)

Conclusion

When it comes down to it, both Velocity and Finmo are solid platforms that will get the job done. Which one is right for your organization will depend on a few factors. Hopefully, this blog has given you a clear picture of what each one has to offer and will help you make the best decision for your organization.

Book a demo